A new preliminary plan for real estate investment has been set by the Orange County Employees Retirement System (OCERS), based in Santa Ana. Essentially, they intend to make three commitments ranging from $125 million to $175 million, which will be to their core real estate portfolio. In addition, they intend to make a four more commitments ranging from $75 million to $125 million for their non-core investments. This will be for the 2019 fiscal year. OCERS is a $15.7 billion pension plan that is known for making lucrative investments.

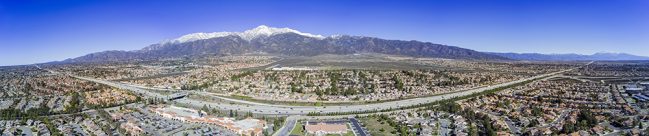

RC Plaza is a popular shopping center in Rancho Cucamonga, CA. It is found where East Foothill Boulevard and Archibald Avenue intersect. It has been announced that the shopping center has been sold for $9,795,000 recently. The purchasers have been revealed to be Voit Real Estate Services and the Hanley Investment Group Real Estate Advisors. The latter is a real estate advisory and brokerage firm that has won numerous awards over the years.

The shoreline of California is changing and the sea level is rising as a result of climate change. It is believed that this will result in many properties being at risk of flooding within the next three decades. This was revealed by a study completed by the Union of Concerned Scientists (UCS).

Orange County is notoriously low in its supply of industrial properties. However, it now seems that change is afoot. A 232,000 square foot, four building project will soon start construction in the northern part of the county.

An important question is how much technology will be able to replace the human players within commercial real estate deals. That said, most experts agree that it is highly unlikely that it will ever be possible for brokers and agents to be fully automated, this despite an increase in things such as QR codes. However, a question that does come up is whether or not it is truly necessary to have a broker present during every deal.

Understanding the Roles in Commercial Real Estate

There are many different players in every commercial real estate deal. It doesn’t matter whether people have an existing space and wish to renew their lease, whether they want to start a brand new lease, or whether they wish to purchase a piece of commercial real estate. There are always two specific sides to the story. First, there is the agent who represents the tenant or buyer and negotiates on their behalf. Second, there is the individual who represents the building’s owner. It is possible in certain states for someone to represent both, and California is one of those states. This is why Orange County is also home to a number of dual agencies, although they do have to adhere to some regulations.

To help both tenant and landlord feel the transaction is fair and transparent, according to Kadosh, brokers may come up with certain caveats in deal structures, word agreements in certain ways or have parties provide tax returns, sales returns and other data, especially with large institutional clients.

The Importance of a Good Broker

Both sides of the deal, however, even in a dual agency, have a specific purpose. The owner’s agent, for instance, is responsible for finding a buyer or a tenant for a commercial property. They do this in a variety of ways, including marketing to prospects. Agents are very good at advertising properties, using signs and online advertisements for properties and finding inquiries and interest in them. At this point, however, they often find themselves quite overwhelmed with the elements within a negotiation. It is vital, therefore, to have a good broker on board.

Such arrangements will work just fine when your broker is showing you properties represented by brokers in other offices. However, the situation gets cloudy if your broker’s own office has taken listings for spaces that you want to see. This puts your broker in an awkward position. The broker is duty-bound to find you the best space, regardless of who has the listing, but is also committed to contribute to the success of the office.

The Role of the Procuring Agent

Meanwhile, there is the procuring agent who wants to find a space for the would-be tenant. Should there be a simple list that shows all available buildings, and should this list be easily accessible, then there would be far less need for a broker, although this role would not be eliminated in full. This is seen, for instance, in residential properties because of the fact that these are listed on a variety of different websites. Commercial real estate agents do not have this luxury, however, relying mostly on Loopnet. Unfortunately, this isn’t properly governed, nor is it overly accountable, which means that it can’t truly be depended on.

Perhaps a good analogy of the broker is that of the flight attendant. Many believe that the role of the flight attendant is to serve drinks and make people have an enjoyable time. In reality, their role is to help individuals should things go wrong. Yet, it is very rare for things to actually go wrong, which is why they actually have the time to serve drinks and food as well. They can never be fully replaced or fully automated, however, no matter how good a self-serve system they may be able to implement.

According to the Allen Matkins UCLA Anderson forecast, the office building market in Orange County in particular is now very positive.

The sentiment for San Diego and Orange County markets has also rebounded from the June 2017 survey. In each of these markets this indicates future rental rates and vacancy rates will be better than they are today.

It seems that 2019 was the year in which people started to invest in hotels across Southern California. This makes sense because it is a hugely popular tourist destination and visitors are happy to pay quite significant prices. So much so, in fact, that there are now some concerns about affordability for the average middle class Californian. Southern California hotel investments are on the rise.

As the weather warms up, families across California are planning summertime visits to the beach. But overnight trips to the state’s famous coastline are becoming increasingly difficult for middle-class residents to enjoy because the price of admission is soaring.

Many businesses in Orange County choose to lease their building after weighing up the pros and cons of leasing vs buying. When people lease a property, they will need to pay a monthly amount to their landlord. There are times, however, where the monthly rent can increase, sometimes by as much as 40 percent! Learn why their may be a commercial rent increase in orange county.

Rent is usually a substantial cost for a business. This is why it is so important that, before you sign a commercial real estate lease, you get your budget in order. Indeed, commercial real estate experts always talk about the importance of proper planning and preparation.