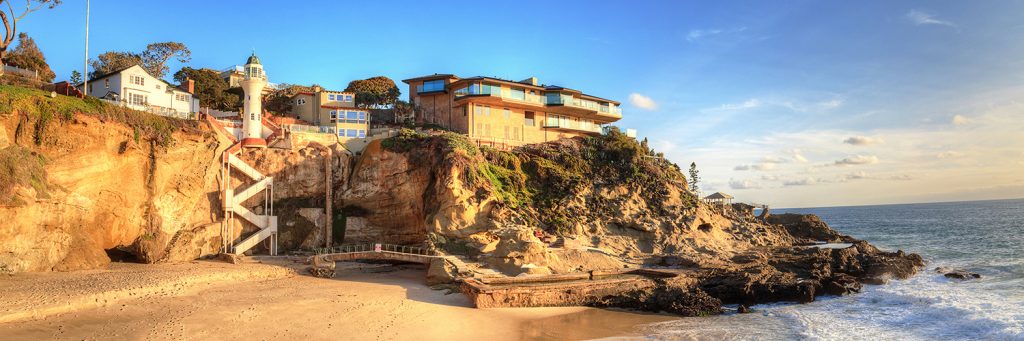

Laguna Beach is a popular seaside resort in the south of Orange County, California. It is popular because of its year round mild climate, environmental preservation, scenic coves, and artist community. According to the 2010 census, some 22,723 people lived there at that time.

Laguna Beach has an interesting history, being first a Paleoindian territory. This was followed by the Tongva people, who were conquered by the Mexicans. During the Mexican-American War, it became part of the United States. In the 1870s, Laguna Beach was settled, although it wasn’t officially founded until 1887. 40 years later, it was incorporated as a city. A council manager form was adopted for the city’s government in 1944. Interestingly, to this day, Laguna Beach has been able to isolate itself from urbanization thanks to the dedicated greenbelt, limited highway access, and surrounding hills. The coastline, meanwhile, is protected by a vast stretch of state conservation area and state marine reserve.

The greatest industry for Laguna Beach is tourism. Some 3 million people visit the city every year. They are also attracted by the numerous festivals that take place here, including Kelpfest, the Bluewater Music Festival, the Art-A-Fair, the Sawdust Art Festival, the Festival of the Arts, and the Pageant of the Masters.

Laguna Beach Commercial Buildings for Sale & Lease

The economy of Laguna Beach is particularly interesting for small business owners. This is because the city has a small town, quaint and quirky feel to it, mainly thanks to its artist community. As a result, residents are reluctant to welcome large chain stores. Small business owners have a chance of setting up a successful enterprise, therefore. While property investors only have one option when it comes to commercial real estate, which is to buy it, business owners need to decide whether they should lease or purchase their property. Both Laguna Beach commercial buildings for sale & lease options have significant pros and cons that must be investigated in detail.

Unfortunately, comparing a lease to a mortgage is far more complex than just putting the monthly cost side by side. For starters, both require a starter investment, which is either an agreed security deposit, or a 30% down payment. Furthermore, both have associated costs, including renovations, utilities, and insurance. The two options also have distinct tax advantages and disadvantages to contend with. Lastly, there is the fact that while a mortgage requires a larger investment, it also leads to a potential of a return, whereas a lease does not. Choosing between the two options, therefore, means putting every pro and con down and figuring out which ones weigh the heaviest for your personal situation. There is no right or wrong answer in this.

Trends in Laguna Beach Commercial Property for Sale

One place to start with comparing your options, whether you want to run a business or make an investment, are trends in Laguna Beach commercial property for sale:

- Multifamily properties in Orange County usually cost around $314,841.90, which is a 0.7% rise compared to the last three months, and one year rise of 10.5%

- Office properties in the county usually cost around $311.66 per square foot. This is a quarterly decline of 0.2%, although a 11.3% year on year rise.

- Industrial properties in the county usually cost around $222.13 per square foot, which equates to a quarterly rise of 2.7% and a year on year rise of 10.9%.

- Retail properties usually cost around $408.88 per square foot, which has been stagnant over the past quarter. Year on year, however, this is a 14.5% rise.

Laguna Beach Commercial Property for Lease

While Laguna Beach is very friendly and welcoming to small business owners, the fact remains that the 30% deposit required to be accepted for a mortgage is more than most businesses can afford. Even if they were to have that kind of capital, they cannot tie it up in a mortgage, earmarking it for business growth instead. However, nothing in the world of commerce is straightforward, which is why you still have many important decisions to make before you can actually negotiate for a Laguna Beach commercial property for lease.

Get the Help of Professionals

Before you do anything, you need to make sure that you have surrounded yourself with the right people. Start by gauging the opinions, needs, desires, and requirements of your staff if you already have a business. After that, you need to find a lawyer who specializes in commercial real estate laws and taxes, and an accountant who understands your books, financial capabilities, liabilities, risks, and assets. Other professionals may also be relevant, but those two are absolutely vital if you are to get the best possible deal.

Find a Broker

It is now time to start looking for properties. Unfortunately, this is not as easy as what it is with residential properties, where you can simply contact an owner and ask for a tour. With commercial real estate, you need a broker. Broker fees are generally paid for by the landlord, which is a bonus. However, the difficulty is that you have to choose between two different types of brokers: the tenant broker and the leasing agent. On paper, tenant brokers are the better option, as their goal is to make sure your needs are met. This is in contrast to the leasing agent, who works mainly on behalf of the landlord. However, tenant brokers want you to sign a representation agreement, which means you are limited to the different properties you are able to see, as they must be on your broker’s books. With the leasing agent, by contrast, you can enlist the services of as many as you would like, meaning you can also see far more properties.

Find the Property

Once you have decided on your broker, it will be time to view the properties. If you come across one that seems perfect to your needs, the next stage of the process will begin, which is the stage of negotiations. Leasing contracts are very different from residential tenancy agreements in as such that every point on them can be negotiated. This is why it is so important to have an experienced lawyer and accountant who are in your favor, as they will make sure you don’t pay over the odds on any of the elements. Some of the most pertinent issues they will be able to discuss for you are:

- The length and extent of your personal guarantee.

- How much you have to pay each month for the lease itself, and what that is based on

- The type of lease that is most beneficial to you (percentage lease, net lease, triple net lease, or gross lease).

- The duration of your lease and what happens when it comes to an end

- The possible rent increases, what they are linked to, and how much would be too much

- Who takes care of maintenance

- To what extent you are able to change the inside of the building and who will carry those renovation costs

- Whether you can signpost your store on the outside of the building

- Whether you can sublease some space and, if so, under what conditions

- What types of exit clauses are available should you want to leave early

- Your right to transfer your lease if you were to sell your business to a third party

- Specific clauses, such as exclusive use or co-tenancy

- The security deposit

What About Purchasing the Property?

What the above demonstrates more than anything else is how complex a lease agreement is. You would be forgiven for thinking that purchasing is the much simpler, and therefore better option. However, there are a few things to remember with a purchase. First of all, there is the matter of the 30% down payment, as a significant stumbling block to most people. Secondly, there is the fact that you will be limited as to how much you can change the property, particularly on the outside, according to local ordinances and building codes. Thirdly, you will be subject to zoning restrictions, meaning you can only run certain types of businesses out of your property. You can apply to have the property re-zoned but this is incredibly costly and there is no guarantee that you will be successful. A final issue to remember is that, unless you use the entire property for your own needs, you will become a landlord. Once you do, you will have to deal with all the points on the above list once again, only this time from the opposite perspective.

There is an alternative, which is to invest in a commercial real estate investment trust (REIT). Commercial REITs are very popular because they have enabled everyday people to invest in real estate without having to purchase a full property. While very beneficial on paper, investing in a REIT is not suitable for those who run their own business, as a REIT member never fully owns the property outright. With a REIT, commercial real estate really becomes nothing but an investment that floats about somewhere in the darker realms of your personal finances.