RC Plaza is a popular shopping center in Rancho Cucamonga, CA. It is found where East Foothill Boulevard and Archibald Avenue intersect. It has been announced that the shopping center has been sold for $9,795,000 recently. The purchasers have been revealed to be Voit Real Estate Services and the Hanley Investment Group Real Estate Advisors. The latter is a real estate advisory and brokerage firm that has won numerous awards over the years.

Hanley Investment Group’s team is comprised of innovative specialists who deliver superior results that consistently exceed client expectations. Clients rely on Hanley Investment Group to be a knowledgeable and trusted source for valuation services, market information, and retail property acquisitions and dispositions. We show personal attention to each client and provide a powerful customer experience focused on achieving results.

Positive Reaction to the Sale

The sale of the shopping center has been met with anticipation and excitement. This is particularly true because of the partnership of the two buyers. While the Hanley Investment Group has received national recognition, Voitco is based in Orange County, one of this country’s biggest hot spots for commercial real estate.

Voit Real Estate Services is a privately held, broker-owned Southern California-based commercial real estate firm that has been providing strategic property solutions for our clients since 1971. Throughout our 45+ year history, the firm has completed more than $48.1 billion in brokerage revenues encompassing more than 46,000 deals.

Background Information on RC Plaza

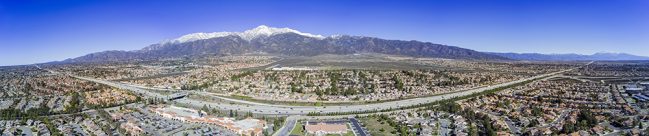

The Rancho Cucamonga Shopping Center was originally constructed in 1984. It is made up of nine individual retail properties and measures 37,239 square feet in total area. It takes up 3.01 acres of land within San Bernardino County. It is a highly popular spot, with a number of national tenants, including Pizza Hut and Starbucks. The latter also includes a drive-thru. Meanwhile, the property that has been purchased represents an RC Plaza shopping center majority share. Hence, a 15,717 square foot multi-tenant building is also included, although this is owned separately and therefore not an actual part of the sale.

One of the things that stood out for the investors about the RC Plaza is that it has tremendous value-added attributes. It is an excellent asset that has a surprisingly low square foot price. The rents are also below market value and the Starbucks building a standalone block on a parcel of its own. This means that there is the potential for investors to eventually sell the property off on its own, rather than selling it as a leased asset.

Meanwhile, the purchase of the property also enabled the building of a solid professional relationship between buyers, sellers, brokers, and agents. It was clear that the buyer was well aware of the specific characteristics they wanted. They have since stated that they particularly valued the services provided by their broker and that they hope this relationship is one that will continue for many more years. It is not clear whether either of the two businesses is planning to make further investments in Orange County commercial real estate soon.

The RC Plaza also includes a range of secure tenants. In fact, 71% of those in the occupied spaces have been there since 2012. In 2006, the Starbucks drive-thru was constructed, and a new 10-year lease for the business was signed in 2015. This means that they are clearly committed to remaining in the area long term. Indeed, Starbucks is a brand that many retail property owners want to attract due to the fact that they exceed earning expectations regularly.

Coffee giant Starbucks has bolstered its loyalty program and maintained steady same-store sales growth, but it still hasn’t been able to grow at a fast enough pace to placate investors. The company’s revenue grew 14 percent to $6.03 billion, better than the $5.9 billion analysts had expected.

Of course, Starbucks is facing a number of challenges as well. Additionally, the property itself has a range of characteristics that could be seen as quite challenging. However, the investors have exerted due diligence before agreeing to formalize the contract and before they even agreed to go into escrow. In so doing, they were able to retain the best possible value for the seller, while at the same time ensuring that all transactions were completed smoothly and with ease.

The Retail Industry in Southern California

Investing in retail is risky as it is still unclear what the impact of online shopping would be on retail stores. However, there continues to be a strong potential for growth as well, particularly in Southern California. This is because very little space is available and any properties that go up for sale are usually snapped up very rapidly. Indeed, the RC Plaza property has received a lot of interest and it is believed that it will also continue to be a high-value investment for many more years.

Reactions from Voit Real Estate and Hanley Investment Group

Voit Real Estate is incredibly excited about the deal. As a broker owned and privately held firm based in Southern California, they have a real sense of affinity with the community itself. Their focus is on providing strategic solutions for property investments based on the needs of their clients. The company has existed for almost half a century, during which time they have bought, sold, and developed a number of projects. They are known across Southern California for their fantastic investment advice, brokerage, market research, and financial analysis. In so doing, they have helped countless investors create future and forward-thinking strategies that add a lot of value to their portfolio.

Meanwhile, the Hanley Investment Group focuses particularly in investments in retail properties. They operate across the country, not just in Southern California. They like to take a personal approach to their investments, forming partnerships with lending institutions, investors, property owners, and developers. They are known to always be able to get the highest possible value out of any deal they are involved in.

Rancho Cucamonga has welcomed this latest development with open arms. It also means that the stores in the plaza can continue to operate, thereby contributing to the economy.